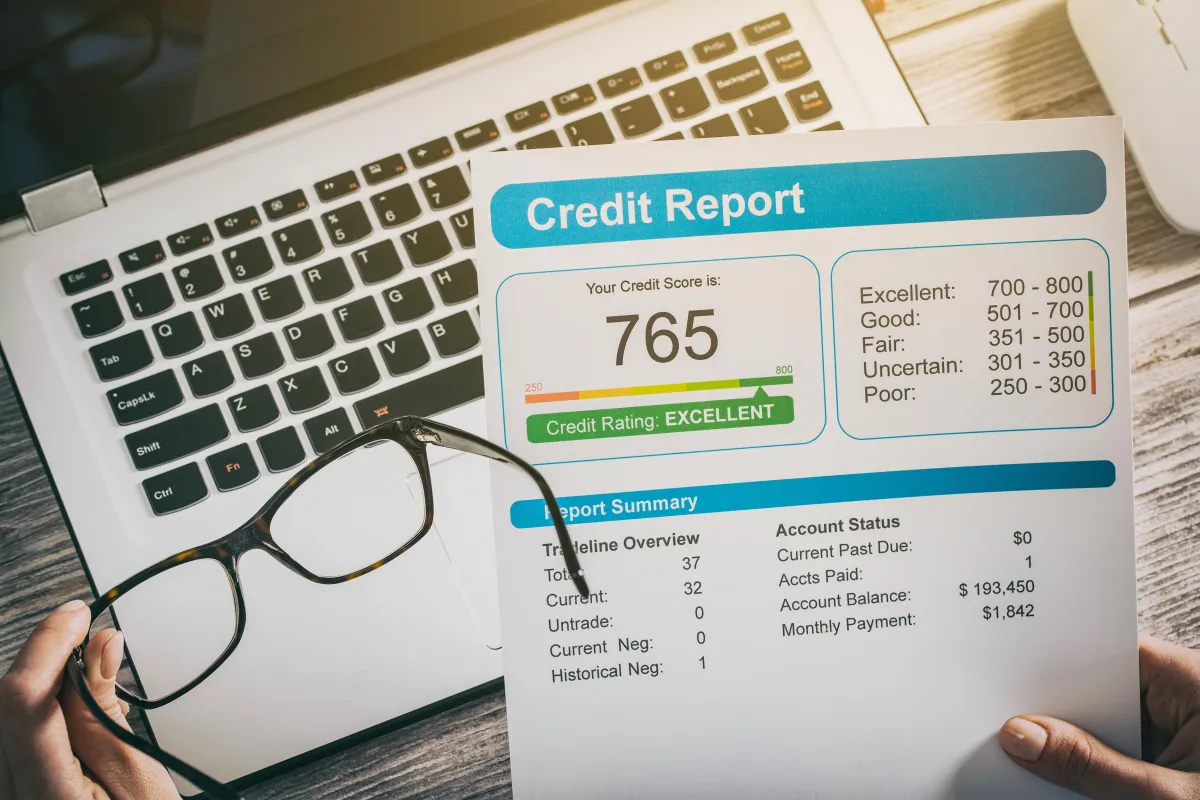

HOW WE HELP YOU TRANSFORM YOUR CREDIT

Pull Your 3 Bureau Credit Report

Create Your Account with IdentityIQ.com, then pull your 3B Report. Get $1000,000 in Identity Theft Protection!

Schedule Your Call With Us

Choose a Date/Time on Our Calendar and Get Your Call Booked With Us

Get Your Credit Reviewed

We Provide a Free 10 min Review of Your Credit Profile. We Will Help You Find The Biggest Problems On Your Report and Get You On the Right Path

Develop a Plan

Based On What We Find on Your Report, We Help You Develop A Plan To Get Them Fixed

about us

We’ve been where you are—watching our credit scores drop over small mistakes, paying thousands more in interest, and feeling like every financial goal was slipping further away. We built this site to help you avoid the credit traps that cost you your dreams.

Did you know every 10 points you lose on your credit score can cost you over $30,000 in interest over your lifetime? That’s like living on financial hard mode, where your car, your mortgage, and your credit cards all become more expensive than they should be.

Our mission is simple: to empower you to build, protect, and leverage your credit so you can access the funding you need without paying a fortune in interest. We review your credit, build a customized action plan, and help you strengthen your credit step-by-step.

We’re here to help you reclaim your financial future. Grab your credit report, book a call, and let’s get to work.

Frequently Asked Questions

How Can I Obtain My Credit Report?

You're entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. You can request these reports through IdentityIQ.com or MyFreeScoreNew.com

How Can I Improve My Credit Score?

Improving your credit score involves:

- Paying Bills on Time: Consistently making on-time payments has a significant positive impact on your credit score.

- Reducing Outstanding Debt: Lowering your credit card balances and overall debt can improve your credit utilization ratio.

- Avoiding New Credit Applications: Each new credit inquiry can slightly lower your score; apply for new credit sparingly.

- Maintaining Long-Term Accounts: Keeping older accounts open can positively affect the length of your credit history

How Long Do Negative Items Stay on My Credit Report?

Most negative information, such as late payments or foreclosures, remains on your credit report for seven years. Bankruptcies can stay for up to 10 years.

Why Do I Have Different Credit Scores?

Credit scores can vary because:

- Different Credit Bureaus: Each bureau may have slightly different information.

- Scoring Models: FICO and Vantage Score use different algorithms.

- Lender-Specific Models: Lenders may use proprietary scoring models tailored to their criteria.

How Does Debt-to-Income Ratio (DTI) Affect Creditworthiness?

While DTI doesn't directly impact your credit score, lenders consider it to assess your ability to manage monthly payments and repay debts. A high DTI can lead to loan application denials, even with a good credit score.

What Should I Do If I Find an Error on My Credit Report?

If you identify inaccuracies on your credit report, promptly dispute them by contacting the credit bureau reporting the error. Provide documentation to support your claim.

STEP 1:

STEP 2:

Facebook